can you ever owe money on stocks

You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero. Can you ever owe money on stocks Tuesday 22 February 2022 Edit.

Can You Ever Owe Money On Stocks Quora

Answer 1 of 7.

. A stock is a type of. However if you buy stocks using borrowed money you will need to. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to.

If you invested 1 every day in the stock market at the end of a 30-year period of time you would have put 10950 into the stock market. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100.

Can you owe money by buying stocks. The pros and cons. You will not owe money if a stock declines in value.

Margin accounts allow you to buy shares of a stock funding the purchase with up to 50 debt. If you invest in stocks with a cash account you will not owe money if a stock goes down in value. If you invest in stocks with a cash account you will not owe your broker money even if the stocks go to zero.

Can you make money on forex. That means the value of your stock decreased by 20. However while this cannot happen the.

For these reasons cash accounts are likely your best bet as a beginner investor. But assuming you earned a 10 average annual return. A card will have a 0 period during which you pay no interest for example 28 months and sometimes youll pay a small fee.

Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy stocks. If however the stock price went up to 200 per share when you. Margin borrowing available at most.

Yes if you engage in margin trading you can be technically in debt. If the stock market is down and the investment price drops below your purchase price youll have a paper loss. Thus if you borrowed 50 of the money you used to buy a stock which is a 2X leverage and the stock falls lower than half of the price you bought it.

Should You Ever Short Stocks. So if you wanted to buy a stock for 100 you could put 50 of your own money in. My own view it is unadviseble to.

You may owe money or shares which is essentially the same in practice. If you acquired the stocks with your own income you will not owe your brokeragent any money if the value of the equities drops. The value of your investment will decrease.

Answer 1 of 3. When a person buys a security on margin a broker is lending money to purchase. There are specific instances where a person can be in debt from stock purchases.

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

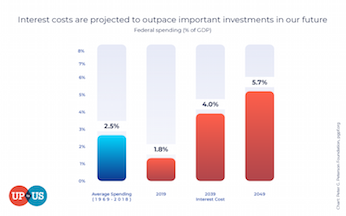

Who Does The Us Owe Money To 2020 Update I Up To Us

Does Your Broker Owe You Money If You Ve Lost Money In The Market And It S Your Broker S Fault You Can Get It Back By Daniel R Solin 2006 Uk B Format Paperback For

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

![]()

Can Stocks Go Negative Will You Owe Money

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

Can Stocks Go Negative Will You Owe Money

:max_bytes(150000):strip_icc()/Enron-One-of-the-Biggest-Stock-Market-Scams-of-All-Time-1-469969c86d7045899e66e0e1f3663010.png)

Can A Stock Lose All Its Value

![]()

Can Stocks Go Negative Will You Owe Money

Debts Owed To Vs Debts Owed By The U S

6 Common Reasons Your Investments May Trigger An Irs Audit Bankrate

Do You Owe Money If Your Stock Goes Down Quora

Can You Use Home Equity To Invest Lendingtree

Can You Lose More Than You Invest In Stocks The Answer May Surprise You Financebuzz

38 Owe Money Stock Photos Pictures Royalty Free Images Istock

It Is Costing More To Survive Now I Owe 109k In Student Loans And The Balance Keeps Going Up As The Loan Servicer Continuously Tacks On More Money With High Inflation How

Invest In International Stocks Forbes Advisor

In California Consumer Debt Isn T Collectable After 4 Years Los Angeles Times