idaho vehicle sales tax calculator

For vehicles that are being rented or leased see see taxation of leases and rentals. Take your original purchase price deduct any trade-in values and multiply against the sales tax rate.

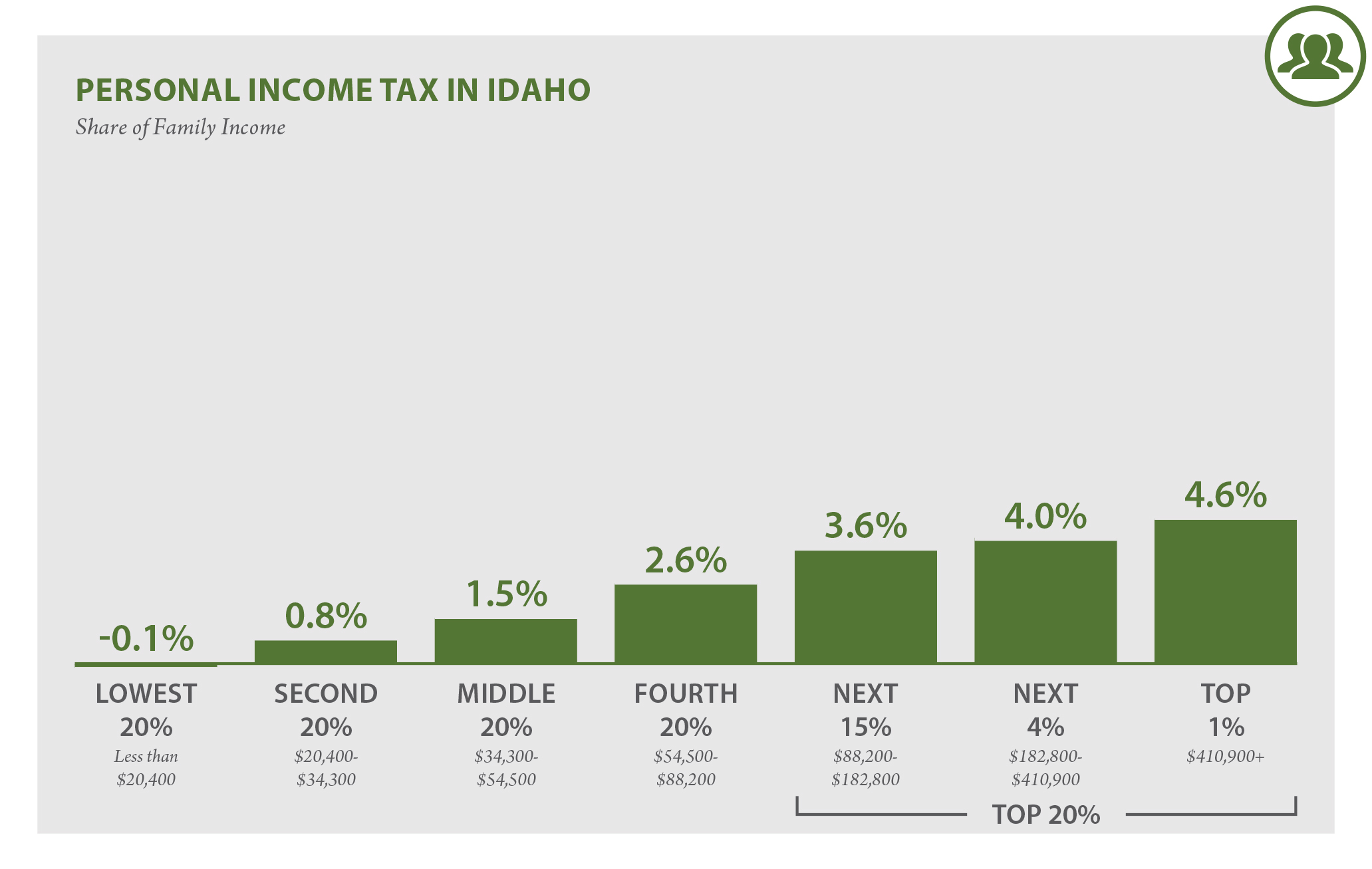

Idaho Who Pays 6th Edition Itep

Its fairly simple to calculate provided you know your regions sales tax.

. Vehicle Tax Costs. Once you have the tax. Dealership employees are more in tune to tax rates than most government officials.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122. Sales Tax Rate s c l sr.

Idaho car tax is 227100 at 600 based on an amount of 37850 combined from the sale price of 39750 plus the doc fee of 300 minus the trade-in value of 2200. By using the Idaho Sales Tax. Vehicle tax or sales tax is based on the vehicles net purchase price.

And special taxation districts. Car Tax By State Usa Manual Car. Calculating Sales Tax Summary.

So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. The state sales tax rate in Idaho is 6000. You can view your local Idaho sales tax rates using TaxJars sales tax calculator.

This guide is for individuals leasing companies nonprofit organizations or any other type of business that isnt a motor vehicle dealer registered in Idaho. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Local level non-property taxes are allowed within resort cities if approved by 60 majority vote.

Enter the Product Service Cost. Its easy to calculate the state sales tax on your vehicle purchase in Idaho. Pay the Idaho retailer tax on the sales price of the motor vehicle.

Find your state below to determine the total cost of your new car including the. Make sure the retailer gives you a completed title to the motor vehicle and a detailed bill of sal e showing you paid tax. For example imagine you are purchasing a vehicle for 60000 with the state sales tax of 6.

With local taxes the total sales tax rate is between 6000 and 8500. Interactive Tax Map Unlimited Use. In addition to taxes car purchases in Idaho may be subject to other fees like registration title and plate fees.

How to Calculate Idaho Sales Tax on a Car. Idaho Registration fees are about 231 on a 39750 vehicle based on flat rate that fluctuates depending on vehicle type and weight. You can always use Sales Tax.

Please select a specific location in Idaho from the list below for specific Idaho Sales Tax Rates for each location in 2022 or calculate the Sales Tax. In virtually every state that Ive seen that operates this way you pay tax based on where youre going to register the vehicle and you can register the vehicle typically where you have proof of residence. The customer has paid the lease in full.

2021-2022 Tax Brackets Tax Calculator. Additional taxes depending on your location or the data may be outdated. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

With local taxes the total sales tax rate is between 6000 and 8500. Its easy to calculate the state sales tax on your vehicle purchase in Idaho. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Idaho collects a 6 state sales tax rate on the purchase of all vehicles. If you are unsure call any local car dealership and ask for the tax rate. 6 is the lowest possible tax rate Pocatello Idaho7 8 85 is all other possible sales tax rates of Idaho cities9 is the highest possible tax rate Sun Valley Idaho Fortunately the sales tax rate in Idaho is usually only the state rate of 6 although.

How to Calculate Idaho Sales Tax on a Car. Choose Normal view to work with the calculator within the surrounding menu and supporting information or select Full Page View to use a focused view of the Idaho Sales Tax Comparison Calculator. The retailer will forward the tax to the Tax Commission.

Idahos state sales tax is 6. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Among the 112 local tax jurisdictions across the state the sales tax averages out to around 6074The good news is that multiple Idaho counties do not collect additional sales tax so the rate in those particular counties is 6.

Calculating Sales Tax Summary. The highest combined sales tax rate for car purchases is in the city of Sun Valley which has a 9 sales tax. As far as other cities towns and locations go the place with the highest sales tax rate is Riggins and the place with the lowest sales tax rate is Cottonwood.

Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies. Our free online Idaho sales tax calculator calculates exact sales tax by state county city or ZIP code. Ad Lookup Sales Tax Rates For Free.

Best Car Insurance. Depending on local municipalities the total tax rate can be as high as 9. You can find these fees further down on the page.

Among the 112 local tax. The most populous zip code in Idaho County Idaho is 83530. The Idaho ID state sales tax rate is currently 6.

The one with the highest sales tax rate is 83549 and the one with the lowest sales tax rate is 83522. This can be the amount after sales tax or before Sales tax you can choose which at step two. This is the rate you will be charged in almost the entire state with a few exceptions.

There are 19 that. Sales Tax calculator Idaho. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Your household income location filing status and number of personal exemptions. The average cumulative sales tax rate in the state of Idaho is 604. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

Make sure the retailer writes its sellers permit number on the title. During the year to deduct sales tax instead of income tax if their total sales tax payments exceed state income tax. Motor Vehicle Operators License.

Other local-level tax rates in the state of Idaho are quite complex. This includes hotel liquor and sales taxes. This takes into account the rates on the state level county level city level and special level.

Free calculator to find the sales tax amountrate before tax price and after-tax price. Taxpayers who paid for a. Idaho has recent rate changes Fri Jan 01 2021.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. It explains sales and use tax requirements for those who buy or receive a. In our area here in the Boise area sales tax is six percent but if we sell to an Oregon resident they dont have to pay Idaho sales tax.

The most populous county in Idaho is Ada County. Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of. Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes.

As far as other counties go the place with the highest sales tax rate is Blaine County and the place with the lowest sales tax.

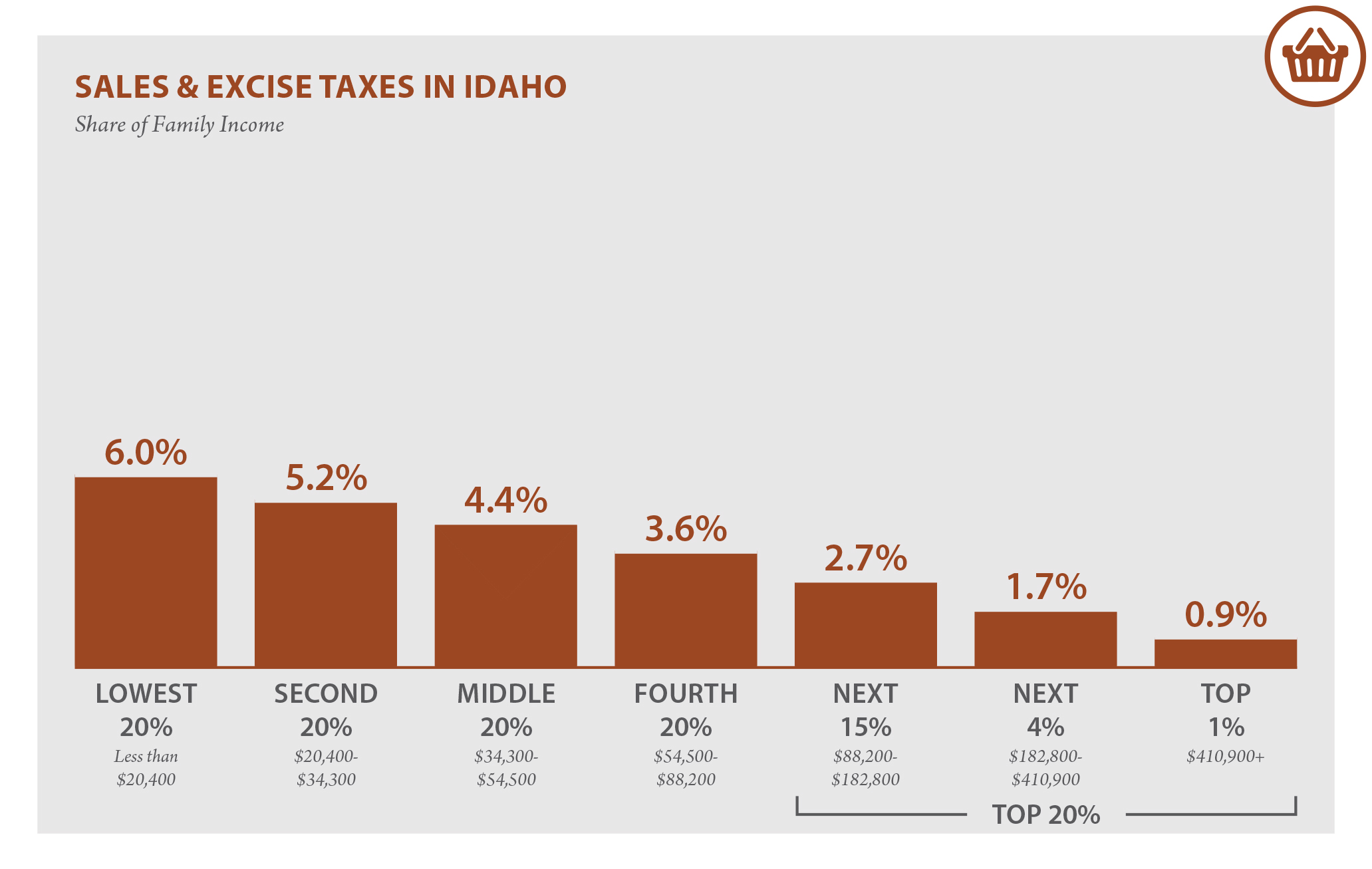

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Form St 101 Download Fillable Pdf Or Fill Online Sales Tax Resale Or Exemption Certificate Idaho Templateroller

Dmv Fees By State Usa Manual Car Registration Calculator

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Dmv Fees By State Usa Manual Car Registration Calculator

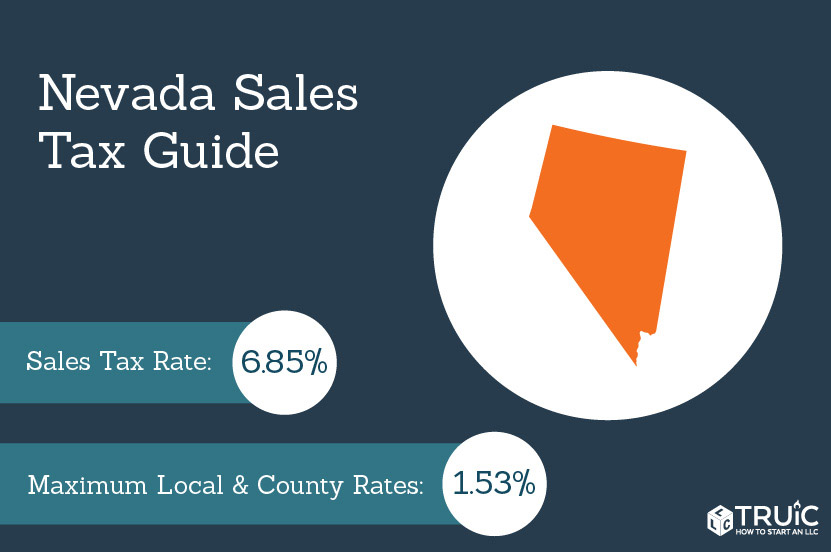

Nevada Sales Tax Small Business Guide Truic

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

State And Local Sales Tax Deduction Remains But Subject To A New Limit Marks Paneth

Idaho Who Pays 6th Edition Itep

How To Calculate Sales Tax Video Lesson Transcript Study Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Idaho Vehicle Sales Tax Fees Calculator Find The Best Car Price

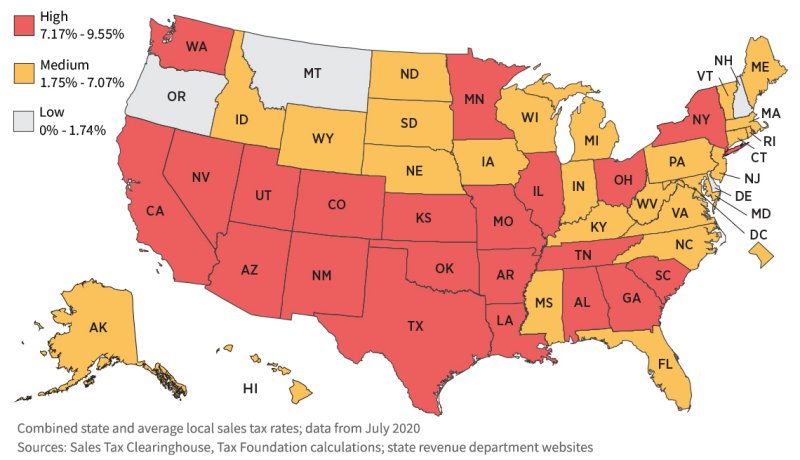

States With Highest And Lowest Sales Tax Rates

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels